Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

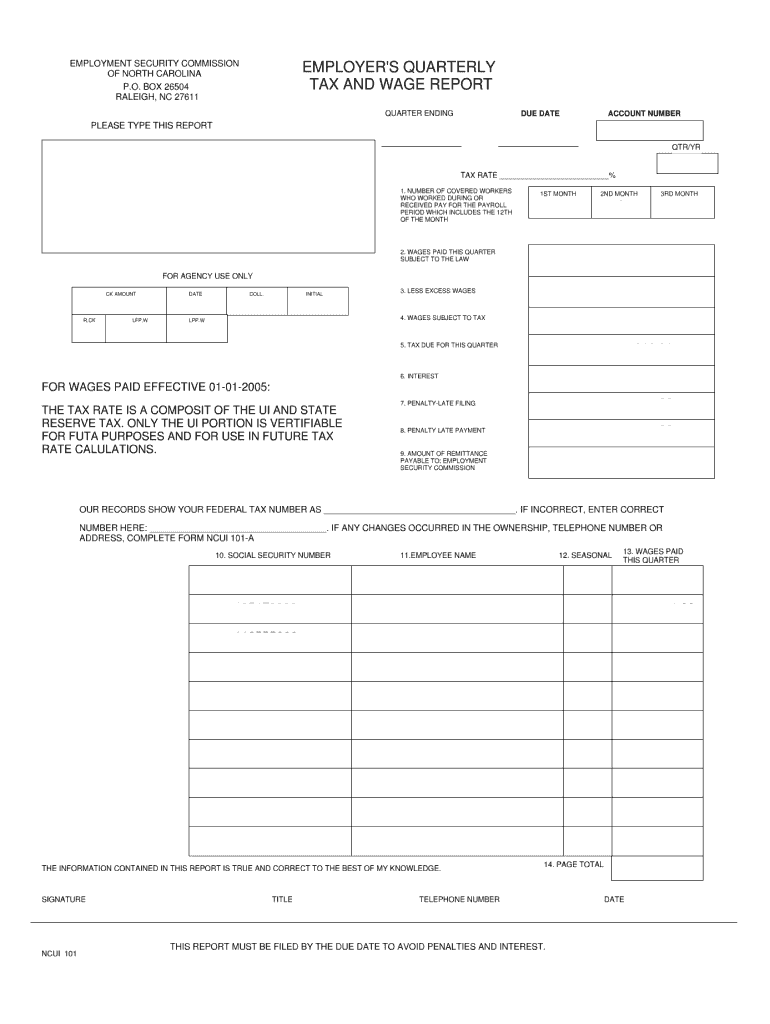

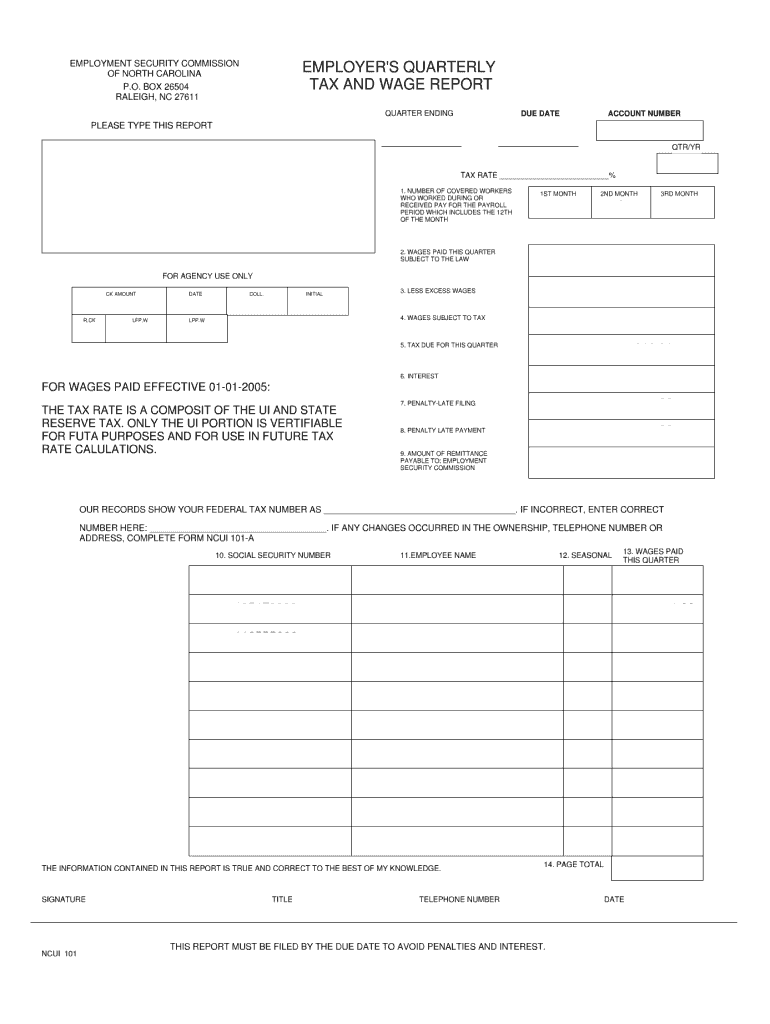

What is nc quarterly tax and?

NC quarterly tax refers to the requirement for individuals or businesses in the state of North Carolina to make quarterly estimated tax payments. These payments are made to pay income taxes and certain other taxes throughout the year instead of waiting until the end of the year to pay the full amount. This helps individuals and businesses to meet their tax obligations and avoid penalties for underpayment. Quarterly tax payments are typically based on the estimated amount of income or profit expected for the year.

Who is required to file nc quarterly tax and?

Individuals, sole proprietors, partnerships, and corporations that have a tax liability in the state of North Carolina are generally required to file the N.C. Quarterly Tax and Wage Report (Form NC-5) on a quarterly basis. Additionally, employers who have employees subject to North Carolina income tax withholding are also required to file this report.

How to fill out nc quarterly tax and?

To fill out the NC Quarterly Tax and Reconciliation Return (Form NC-5Q), you will need to follow these steps:

1. Download the Form NC-5Q from the North Carolina Department of Revenue's website or obtain a copy from your employer.

2. Fill out the header section, which includes your name, Social Security number, address, and filing period.

3. Calculate your gross wages for the quarter by totaling all taxable wages received from your employer.

4. Deduct any pre-tax deductions such as retirement contributions or health insurance premiums from your gross wages to determine your "adjusted gross wages."

5. Determine your North Carolina taxable wages by subtracting any non-taxable wages, such as mileage reimbursements or certain fringe benefits, from your adjusted gross wages.

6. Look up the appropriate North Carolina income tax rate based on your taxable wages using the tax rate table provided with the form.

7. Calculate your North Carolina income tax liability by multiplying your taxable wages by the tax rate.

8. If your employer withheld any North Carolina income tax from your wages during the quarter, enter the amount in the appropriate field.

9. Subtract the amount of any tax credits you are eligible for from your tax liability.

10. Calculate any additional tax due or overpayment by comparing your tax liability with the amount withheld and any credits.

11. If you owe additional tax, include payment with your return. Make your check payable to "North Carolina Department of Revenue" and write your Social Security number and "NC-5Q" on the memo line. If you overpaid, you may request a refund or apply the overpayment to future tax liabilities.

12. Sign and date the form.

13. Submit the completed Form NC-5Q to the North Carolina Department of Revenue by mail or electronically, according to the instructions provided.

It's always recommended to consult with a tax professional or refer to the North Carolina Department of Revenue's instructions for more specific and detailed guidance on filling out the NC-5Q form.

What information must be reported on nc quarterly tax and?

When filing a quarterly tax return in North Carolina, the following information must be reported:

1. Personal Information: Your name, Social Security number, business name (if applicable), address, and contact details.

2. Income: Details of all income received during the quarter, including wages, self-employment income, rental income, interest, dividends, capital gains, and any other taxable income.

3. Deductions: Certain deductions, such as business expenses, qualified retirement contributions, student loan interest, and educator expenses, may be claimed on the tax return.

4. Withholdings: Include details of any North Carolina tax withheld from your income, such as income tax withheld from wages or North Carolina estimated tax payments made during the quarter.

5. Estimated Tax Payments: If you made estimated tax payments for the quarter, provide the dates and amounts of those payments. These payments are typically made by individuals who expect to owe more than $1,000 in tax for the year.

6. Calculation of Tax Liability: Utilize the appropriate North Carolina tax tables or tax rate schedules to determine your tax liability for the quarter.

7. Payment: If you owe any tax on your quarterly tax return, submit the payment along with the form. It's crucial to include the payment voucher with your check or money order.

Remember, specific requirements and forms may differ depending on your individual circumstances or the type of business you operate. It is advisable to review the North Carolina Department of Revenue's website or consult a tax professional for precise and up-to-date information.

When is the deadline to file nc quarterly tax and in 2023?

The deadline to file North Carolina quarterly tax returns for the year 2023 would likely be April 15th, July 15th, October 15th, and January 15th. However, please note that tax deadlines can change, so it is important to consult the North Carolina Department of Revenue or a professional tax advisor to get the most accurate and up-to-date information.

What is the penalty for the late filing of nc quarterly tax and?

The penalty for the late filing of North Carolina quarterly taxes is typically a percentage of the unpaid tax amount. The penalty is calculated by multiplying the unpaid tax amount by the following rates:

- 5% if filed within 1 month after the due date

- An additional 5% if filed between 1 and 2 months after the due date

- An additional 5% if filed between 2 and 3 months after the due date

- An additional 5% if filed between 3 and 4 months after the due date

- An additional 5% if filed between 4 and 5 months after the due date

- An additional 5% if filed between 5 and 6 months after the due date

The maximum penalty is 25% of the unpaid tax amount. Additionally, interest is charged on the unpaid tax amount at the rate of 5% per year.

It's important to note that the penalty and interest rates may change, so it is always recommended to refer to the official North Carolina Department of Revenue website or consult with a tax professional for the most up-to-date information.

How do I edit nc quarterly tax and wage report in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your sample quarterly wage and tax report form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit nc employers quarterly tax and wage report on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit ncui 101 online.

How do I fill out nc employer's quarterly tax and wage report on an Android device?

On an Android device, use the pdfFiller mobile app to finish your north carolina quarterly tax and wage report form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.